Intuit Turbotax 2016 Download Torrent

- Intuit Turbotax 2016 Download Torrent 2017

- Intuit Turbotax 2016 Download Torrent Download

- Download Turbotax Deluxe 2016

- Intuit Turbotax 2016 Download Torrent 2017

- Intuit Turbotax 2016 Download Torrent Full

- 2016 Turbotax Software Download

Turbotax 2016 Torrent Get your taxes are done right and your maximum refund. Covers more than 350 tax deductions and credits (1040, Schedule A). Accurately deducts mortgage interest and property taxes. Turbotax 2016 free download - TurboTax Online 2018, TurboTax Tax Return App, TaxCaster by TurboTax - Free, and many more programs. Publisher: Intuit Downloads: 8,471. TurboTax Tax Return App. Free intuit turbotax 2016 torrent download software at UpdateStar - TurboTax Online Tax Software. The quick and smart way to handle your tax return. TurboTax Deluxe maximizes deductions for mortgage interest, donations, education, and more. Intuit_TurboTax_2016.zip 3 torrent download locations monova.org Intuit_TurboTax_2016.zip Other 1 hour idope.se Intuit_TurboTax_2016.zip Other 2 months btdb.to Intuit_TurboTax_2016.zip 1 day. Using BitTorrent is legal, downloading copyrighted material isn’t. Be careful of what you download or face the consequences.

- Pros

Excellent user experience and selection of tax topics. Thorough interview and final review. TurboTax Live provides year-round live video support from experts.

- Cons

Some answers in help database supplied by nonexpert users. Location of help topics uneven; help pane usually not context-sensitive.

- Bottom Line

TurboTax Deluxe offers thorough explorations of tax forms and schedules, and an exceptional user experience to both new and returning taxpayers, but it's help system could be better.

Intuit's TurboTax family of personal tax preparation software and services has a long history of excellence that goes back more than 25 years. This year's product line continues that tradition. Always known for exceptional user experience, TurboTax packs a lot of substance as well as style: It offers thorough coverage of tax topics in an easy-to-follow interview format, and its support rivals and usually bests its competition. This year, however, H&R Block Deluxe wins the PCMag Editor's Choice award in this category because of substantial improvements it has made to it help system and user interface.

- $29.99

- $17.00

- $47.95

- $0.00

- $6.99

- $29.95

- $109.95

Pricing and Features

The lineup and pricing of TurboTax have changed slightly for the 2018 tax year. The company is once again offering its Free Edition (free federal and state for 1040 filers; includes support for the W-2 form, the Earned Income Credit (EIC), and child tax credits). TurboTax Deluxe costs $59.99 for federal taxes and $39.99 per state. It adds the Schedule A, so you can determine whether you'll itemize or take this year's doubled standard deduction. You need TurboTax Premier ($79.99 federal, $39.99 per state) if you have to report on investment income and rental property. TurboTax Self-Employed ($119.99 federal, $39.99 state) lets you record income and expenses on a Schedule C, and includes special guidance and features for self-employed individuals— along with a year's subscription to QuickBooks Self-Employed.

Compared with the rest of the online tax prep players, TurboTax is the priciest. H&R Block Deluxe starts at just $29.99 for federal and $36.99 per state; Premium adds Schedules C-EZ, D, E, and F and costs $49.99 for federal; and Self-Employed costs $79.99 for federal and adds additional guidance for the self-employed. If money is too tight to swing these fees, one option you have is Credit Karma Tax, which offers completely free federal and state filing, or FreeTaxUSA (free federal; $12.95 state). Note, however, that you sacrifice quite a bit when it comes to hand-holding, which most of us end up needing at some point during the process.

TurboTax Live was introduced last year. This service lets you connect with a CPA or EA (Enrolled Agent) via video chat. These tax professionals can then see your screen if you allow it, and do a line-by-line review of your return. Last year, it was available during tax season only. You now can communicate with them all year long, so they can help with tax planning during the off-season. At this writing, TurboTax Live Deluxe costs $119.99.

Though TurboTax Live is a standalone offering, you can add it on even if you've already started preparing your taxes using any product in the TurboTax line. Prices for this addition start at $49.99 for a relatively simple return.

Note that Intuit says that its early prices are subject to change. Many tax websites, including TurboTax, start the season at lower prices than they finish it. This is a good reason not to be a last-minute e-filer. Our reviews are based on list prices rather than deal pricing, which is subject to change as the tax season progresses. However, you'll likely see better deal prices in our auto-generated red commerce links.

A Familiar Format

Many personal tax preparation services still use a format similar to the one Intuit introduced for its desktop software products in 1993. And with good reason: It works beautifully, saving time, easing frustration, and dramatically reducing errors. Instead of shifting your attention between the Form 1040, related forms and schedules, IRS instructions, and third-party reference books, you go through the tax preparation screens one at a time in a logical order. This is especially handy in a year like this one, when filing your taxes has changed considerably since last year. Political rhetoric notwithstanding, e-filing your taxes did not get simpler this year, if you're using paper forms.

TurboTax originated this trend of using a wizard-based approach to tax preparation. The service alternates between stepping you through a Q&A and displaying a list of available tax topics. You provide an answer, click a button to advance to the next screen, and keep answering and clicking until the service says you're done. Next, it combs through your return, lets you fix any problems, and helps you file or print the finished product after you pay for your federal (and state, if needed) returns.

Intuit Turbotax 2016 Download Torrent 2017

All this time, you never have to look at an IRS form or schedule, because TurboTax and its competitors complete them for you in the background. What you do see is expert help in the form of simply worded explanations of tax concepts throughout the process.

A Unique Personality

Every tax preparation service has a personality of its own, made up of a combination of its tone, user interface, and skill at guiding you through its wizard without causing confusion. TurboTax's personality is on display from the start, even before you start filling in dollar amounts.

TurboTax takes a conversational and friendly tone, whereas some competing services, such as TaxSlayer Classic, tend to be more formal and businesslike. You may like this friendliness, especially if you're nervous about your taxes or this is your first time using a tax prep site. Others users may just want to get on with it. In any case, the extra chumminess isn't overdone, nor will it slow you down (usually).

Getting Started With TurboTax

Once you create a username and password, TurboTax displays several life situations that might affect taxes (such as getting married, having children, changing jobs, and buying or selling a home) and recommends the best version for you.

Next, you provide answers to the site's questions about your personal background, including your address, Social Security number, and occupation. When you come to issues that may be confusing, like filing status and dependents, TurboTax Deluxe provides extra guidance in the form of a multistep questionnaire. As you finish, you see a summary of your personal information. The service also asks whether you want to subscribe to MAX Defend and Restore, which includes audit support, help with identity theft monitoring and identity restoration, and priority care, for $49.99.

At this point, you're ready to move on to the real meat of the site—entering your income (you can import your W-2 if your employer supports this), identifying your deductions and credits, and taking care of additional issues like health insurance and other tax-related situations. Sometimes you'll click through a series of questions, while other times you'll just be staring at a form filled with blank fields that you'll need to complete.

A Clean, Lean Look

TurboTax has pared down its user interface considerably over the years; it looks great, yet still provides access to the tools you need. A vertical toolbar on the left side of the screen divides the site into My Info, Federal, State, Review, and File. There are links to other tax tools here, including an abbreviated outline of the site's content and a searchable alphabetical list of tax topics. I would have expected to see these featured more prominently since the site's primary navigation tools are minimal. As it is, you have to click the Tax Tools link at the bottom of the left vertical pane and then click 'Tools' beneath it, which is barely visible.

The bulk of the screen is reserved for the site's actual) in the upper-right corner open a pane that slides over from the right side of the screen, and does not obstruct your view of the current page. The Flag button from last year that let you bookmark pages is gone, replaced with an ad for TurboTax Live.

It's hard to get absolutely lost if you simply read everything on the screens and use the Topic List. TurboTax makes it clear what it's looking for on every page and how you can respond. For example, when it asks for interest earned, it displays two blank fields, one for the related financial institution and one for the dollar amount (you can also import 1099 forms from many supported banks). It then asks a couple of additional questions, and a few more after you click Continue. You're then shown a list of your 1099-INTs; you can edit existing ones or add more. When you're finished here, click Done, and you'll be taken back to your income list to work on other topics.

This is how you communicate with TurboTax throughout the tax preparation process. It asks a question or makes a statement about what it wants and provides buttons and lists of options and blank fields for your answers. Dsp plug in for winamp. Unlike FreeTaxUSA, though, TurboTax lacks a comprehensive navigation outline that lets you zero in on the exact screen you want if you're working out of sequence. Ideally, you should just proceed through the site step-by-step. But when that doesn't happen, there needs to be an easy, accessible way to find your way back to where you need to be.

Understandable Help From Intuit

Intuit Turbotax 2016 Download Torrent Download

There was one advantage to using the actual IRS instructions when you prepared your taxes in the old days: They were comprehensive. They may have been difficult to understand if you weren't a tax preparer, but the answer to your question was in there, somewhere.

Personal tax preparation websites couldn't be expected to be so all-encompassing; they'd collapse under the considerable weight of the tax code. But the explanatory content on these sites has been rewritten so many times and expanded over the years that it's usually easy to understand. TurboTax does an especially good job here, in terms of both clarity and accessibility. It often provides brief, simple explanations of tax topics as it asks its questions. Many words and phrases are hyperlinks that open windows containing additional detail. Often, there's a Learn More link that does the same thing. Sometimes, TurboTax even guesses at a question you might have and provides related FAQs. Competing sites work similarly.

H&R Block Deluxe, though, does a better job of staying on message as you work your way through the site. TurboTax Deluxe sometimes displays help topics in pop-out windows, but other times it shows up in the right vertical pane. I was even booted off the site at least once and dropped into the TurboTax AnswerXchange, an unsecured support site that contains Q&As from both TurboTax staff and other experts, as well as anyone who happens to visit and provide an answer. H&R Block, though, consistently uses the right vertical pane for all context-sensitive help—and it snaps into place quickly, with no loading delay, where the same pane in TurboTax doesn't change unless you search for a topic. The difference between the two this year is startling.

Also, at the time I tested, the '?' link, which was supposed to open the TurboTax Assistant (an excellent aide that helps you narrow down your searches until you find the right answer) wasn't working in the Chrome web browser.

TurboTax does have an innovative help resource that's been improved even more this year. Its TurboTax Live product connects you to credentialed tax professionals (CPAs or EAs) via one-way video chat. You can see and hear them talking in a window and can grant them access to your in-progress return, so they can answer questions and correct problems. When you're finished, they'll review and sign your return. And they'll be available year-round, instead of just during tax season.

Download Turbotax Deluxe 2016

More Assistance

Intuit Turbotax 2016 Download Torrent 2017

TurboTax encourages you to provide more thorough documentation than competing sites, such as Credit Karma Tax; this could be a lifesaver if you're ever audited. When you enter charitable donations, for example, it asks you to select things such as the type, the recipient, amount, and frequency. TaxAct Deluxe Plus Online, though, is the only site that offers a background bookkeeping list for any field that requires calculations.

When you've come to the end of your link. Help links within the interview process are still there; they open new screens containing the explanatory text. The apps offer the same tax topics that are available on the browser-based version, so you can prepare and file even a complex return using them.

It's the combination of a best-of-breed interface with a solid mobile help system that makes the Intuit TurboTax Tax Return App our top choice for filing your taxes on a mobile device.

Intuit Turbotax 2016 Download Torrent Full

Taxes Done Right

If you used TurboTax last year and it worked for you, you might stick with it again this year. It remains an excellent service, and there's definitely something to be said for not having to start from scratch with a new app. If you didn't love the service you used last year, you are preparing your taxes on your own for the first time, or you're making the jump from using paper forms to filing your taxes online, H&R Block Deluxe is your best option. It's a clear Editors' Choice this year because of its solid tax topic coverage, its superior help options, and its top-notch user experience.

When you're finished with last year's finances, you should also give some thought to the future. Maybe you want to make sure you spend your return wisely, or maybe you need a stricter budget so you can pay what you owe the IRS. For your own money, you should read our coverage of the best personal finance software, and if you run a small business you might take a look at our overview of the best accounting software.

Intuit TurboTax Deluxe 2019 (Tax Year 2018)

2016 Turbotax Software Download

Bottom Line: TurboTax Deluxe offers thorough explorations of tax forms and schedules, and an exceptional user experience to both new and returning taxpayers, but it's help system could be better.

Please enable JavaScript to view the comments powered by Disqus.blog comments powered by DisqusDescription

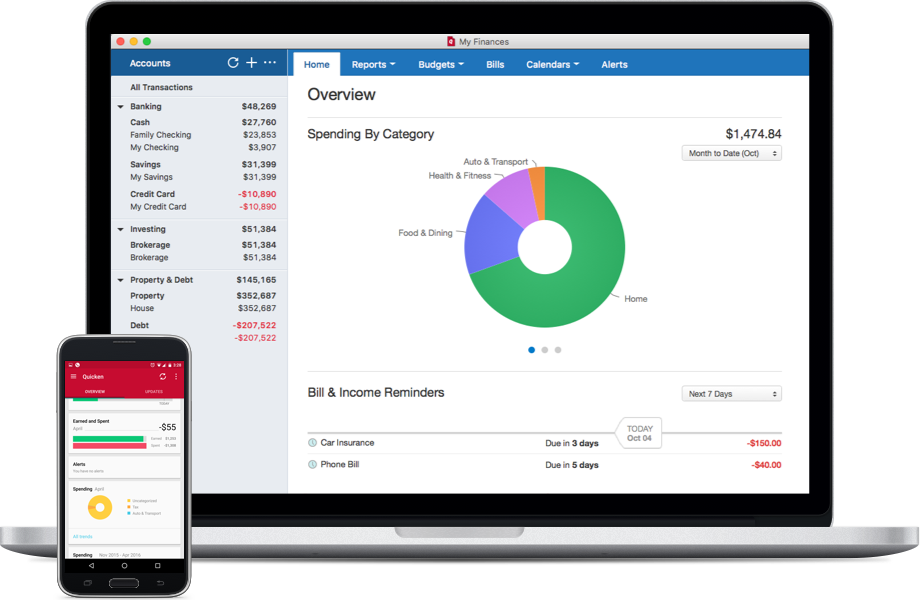

Quicken Deluxe 2016 – Manage your money and save. See your checking, savings, credit card, loan, investments, and retirement accounts in one place. Say “goodbye” to multiple sites, passwords and statements. Top personal finance software, with over 30 years of experience.

See when money’s coming and where it’s going

– Know when paychecks, bills and more are scheduled

– Automatically tracks and categorizes your expenses so you don’t have to

– Understand how much you can spend or save

NEW! See, track and pay your bills all in one place

– Link your bills and Quicken will automatically track the due date and amount due

– Know exactly where you stand with your bills and cash flow without having to log into multiple accounts

– Easily pay your bills on time from right within Quicken

Goals you can live with

– Makes budgeting (and staying on budget) painless

– Automatically sets up budget goals based on past spending

– Customize your plan, and let Quicken track your progress

More tools to help meet your goals

– Even easier to get started, upgrade (to Quicken Mac or Windows), or set up new features

– Helps you create a customer plan to reduce debt

– Shows you how to reach your retirement goals

– Makes tax time easy by importing your info to TurboTax*

– Get free credit monitoring alerts, credit score, and report summary*

Make smart money decisions on the go*

– Check account balances and get timely alerts with the free Quicken mobile app

– Sync information between your computer, tablet, and smartphone

– Snap and store receipts to easily track important purchases